Step by Step guide on how to file the income tax return in Pakistan?

How to File Income Tax Return in Pakistan? Today we will tell our reader about the complete details of the income tax return in Pakistan. A tax return is a form filed with a taxing authority that reports income, costs, and other related tax information. Tax returns permit the taxpayers to estimate their tax charge, schedule tax payments and also appeal to refund if the taxpayers pay overpayment of taxes.

The taxpayers can submit the tax returns on annual basis in most of the countries for an individual or business with reportable revenue (e.g., wages, interest, dividends, capital gains, or other profits).

In Pakistan you can also file for the income tax return easily if you want to buy a new car at a lesser price, want to have the least withholding tax on all your banking transactions, want to enjoy the lower rate on the real estate, want to avail the most reliable services at the airports, excise offices and also if you suffer the loss in your business.

In all these cases you need to file the income tax return in Pakistan as the Federal Board of Revenue has uploaded the income tax return and wealth statement for the fiscal year 2018. The government has introduced a new form under the section of 116A of Income Tax Ordinance 2001—which is associated with the income and assets of non-resident Pakistanis.

There is almost no change in the income tax return for the fiscal year 2018 as compared to the tax return for the fiscal year 2017.

Income tax return for non-resident Pakistanis

Now the non-resident Pakistanis can also fill for the income tax return and required to file a wealth statement under section 116A otherwise their income tax return under section 114(1) cannot be submitted.

Income tax return for Pak Army individuals

Now the Pak Army has also made it necessary to file income tax returns as one of the conditions for promotions in the military and help to widen of the tax base. The Chief of Army Staff (COAS), General Qamar Bajwa has stressed to file tax returns for promotions.

Income tax return for salaried individuals

Earlier the salaried individuals were not required to file the income tax return but now they can also file for its if their incomes were salaries and below Rs.500,000. If you are the salaried individual earning taxable income and not filed for the tax return you are making a bigger mistake.

Mainly, they rendering themselves for severe action on account of non-submission of return, and then in the majority of cases of salaried individuals the tax withheld is more than their actual tax obligation. If you are such a person you are required to submit returns in order to claim the excess deduction as a refund.

Today we will discuss how to file the income tax return in Pakistan and this article is a modest try to guide the taxpayers who want to file their income tax returns on their own without the assistance of any tax lawyer of practitioner and filing for your tax returns and wealth statement is useful for you and the government as well.

If you want to file the tax return in Pakistan you also need to submit the wealth statement because it is compulsory for filing of the income tax return. Deprived of a wealth statement you will not be able to submit your income tax return.

Here is the Step by Step guide on how to file the income tax return in Pakistan?

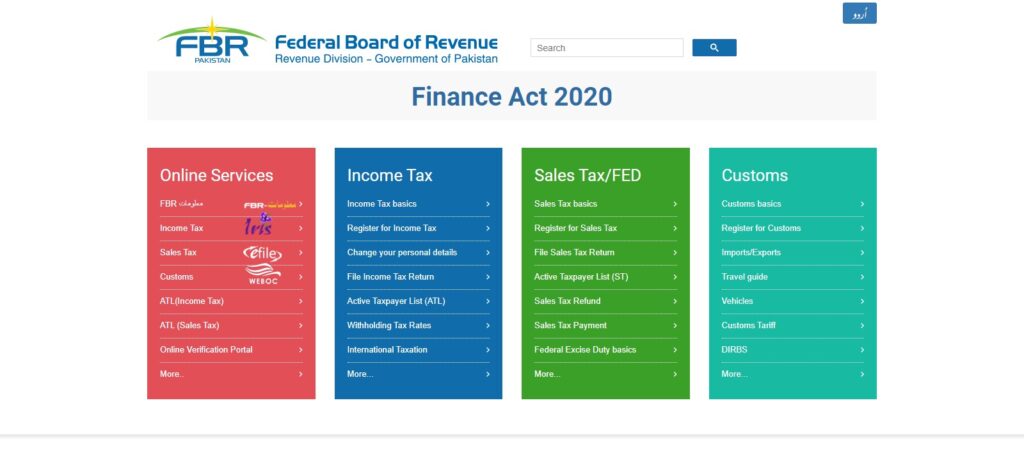

First of all, you need to login to the https://www.fbr.gov.pk/fileOnline

When the website of FBR is open you will find the filling of Income-tax return, in this category you need to click on the Income Tax e-Filing through Iris.

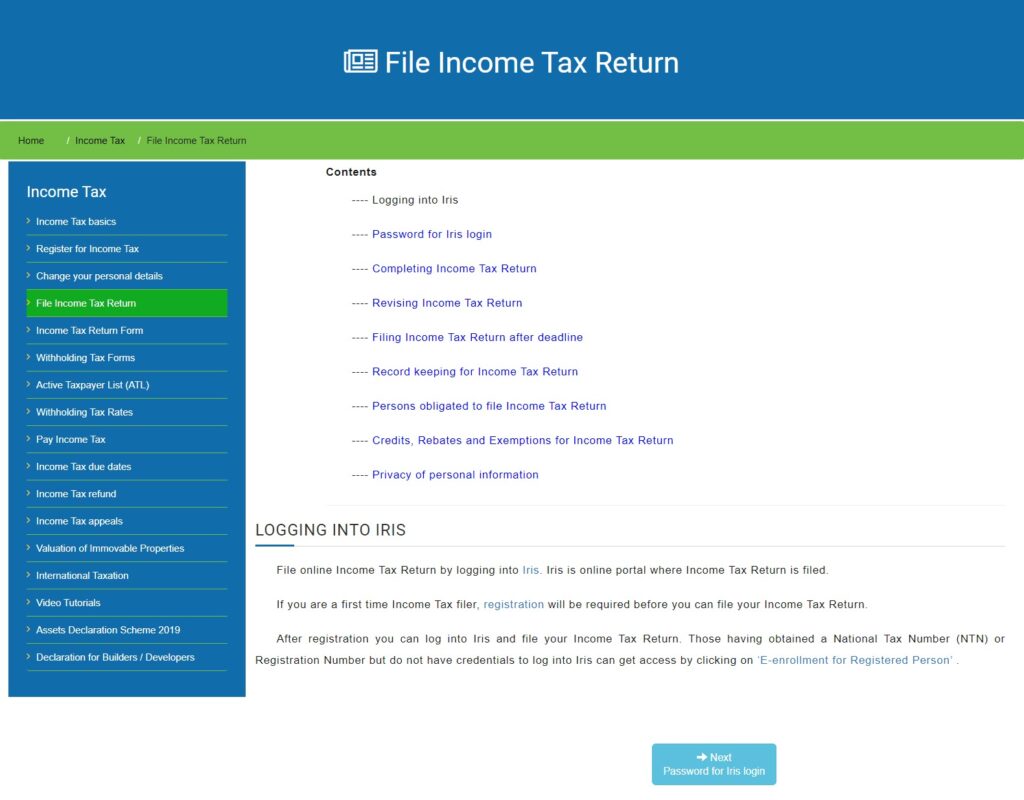

You will find a new window in which you need to write the Registration Number and then your password.

If you don’t already register you need to get enrolled, by clicking on the Registration for Unregistered Person or E-Enrollment for Registered Person. Then you need to submit your CNIC number and phone number (which has to be registered under your own name).

Here are the complete details of Registration for income tax in Urdu Click Here.

Once you registered and get logged in you will see a new window in front of you. In the above bar, you will see the option Declaration. When you put the cursor of your mouse on the declaration option you will see an option Forms. Here you need to fill two forms including;

- 114 (1) (Return of income tax filed voluntarily for the complete year)

- 116(2) (Statement of Assets/ liabilities filed voluntarily)

How to fill forms?

You need to first fill the 116(2) (Statement of Assets/ liabilities filed voluntarily). Click on it you will see a new page where you need to select the period by clicking on the period option.

In the period option, you need to fill the period for this year you want to file for a tax return. Then click on the search option ahead you will see start date, end date and action in the action menu click on the selection you will find the complete form of the 116 (2).

You will find here the different options, you need to fill all the options by providing the correct information about them. After filling the amount details you need to click the calculate option to collect the total amount you provided in the concerned options.

Now in the sidebar, you need to click on the Personal Assets/ Liabilities another form will open in front of you. You need to fill this form by clicking on the + button in the action bar to provide you complete property details and then need to calculate the total amount by pressing the calculate button.

Now again in the sidebar, you need to click on the personalization of the non-assets options you will see another form you also need to fill it completely if the options meet your possessions.

Now you need to calculate the amount by pressing the calculated option above.

Impotent Note:

There is the second last option unreconciled amount which should be Zero otherwise you won’t be able to file for the tax return.

In order to make it Zero you need to fill the Gift option with the total amount, you will get, and then click on the calculate button your unreconciled amount will be zero.

Once your form is filled you need to verify it by clicking on the verification option in the sidebar. Click on it and then verify by providing the pin code given to you by the FBR.

After entering the pin code click on the verify pin and you will verify and then you can submit it by clicking on the Submit in the above bar.

Now you need to fill the 114 (1) (Return of income tax filed voluntarily for the complete year).

Again on the first page, you will see the option Declaration. When you put the cursor of your mouse on the declaration option you will see an option Forms and there you need to click on the 114 (1) (Return of income tax filed voluntarily for the complete year).

Click on it you will see a new page where you need to select the period by clicking on the period option.

In the period option, you need to fill the period for this year you want to file for a tax return. Then click on the search option ahead you will see start date, end date and action in the action menu click on the selection you will find the complete form of the 114 (1).

Here you need to provide the information in by clicking the sidebar options that meet your requirements.

Keep carefully entering all your information in each of the categories and then calculate at the end.

After filling the form again you need to verify it by clicking on the verification option.

Click on it and then verify by providing the pin code given to you by the FBR.

After entering the pin code click on the verify pin and you from will verify and then you can submit it by clicking on the Submit in the above bar.

For more information, you can take the help of the FBR official website help desk.

You can also call at the FBR-Helpline from 9 AM to 11 PM

National: 051-111 772 772

International: 0092- 51-111 772 772

Email: [email protected]